When it comes to online transactions, using a card is the most convenient method to make our purchases. Despite the convenience, typing our card number on the internet carries some risks, and we must be careful. In this guide, we will see in detail what is a credit card, a debit card, and prepaid card, the pros and cons of each method, and what to look out for in online transactions.

Unblock any international website, browse anonymously, and download movies and Mp3 with complete safety with CyberGhost, just for $2.75 per month:

Prepaid cards

It is a given fact that many users are concerned about the dangers of online purchases. They prefer cash on delivery or bank transfer and avoid companies that do not offer any of these options.

Prepaid cards are the solution to these concerns since we can use them the same way we would do with cash.

The prepaid card is a relatively new invention in the field of bank cards. It has been around for several years, but it was created much later than credit and debit cards.

Essentially, our bank issues a card, and we can top it up with any amount we want. Then, we can use this card wherever we want until it runs out of money.

Pros

Prepaid cards are considered to be the safest method for online shopping. If we top it up with a small amount of money – let’s say $10 – this is the maximum risk we take, in case something goes wrong.

In fact, some services, such as paysafecard, do not even require a bank account or access to a credit or debit card. We can do everything with just a few clicks on our computer or smartphone.

These cards usually do not have our on them, which may be requested when paying by card. However, they are connected with our name and address in our bank’s database.

Cons

The main disadvantage of prepaid cards issued by banks is that they typically charge a small fee each time we top up our card.

If we haven’t used the card for a long time, we may run into more fees. Usually, the period that determines whether an account is considered inactive is 12 months.

Prepaid paysafecard

paysafecard also belongs to the category of prepaid cards. It may not have the standard card format, but it has the same benefits in reducing the risk of online payments.

It is accepted in thousands of online stores, such as Steam, PlayStation Store, Riot Games, Epic Games Store, Wargaming, and even Twitch.

It is worth noting that the paysafecard is superior to the corresponding prepaid bank cards because it does not charge a commission.

For example, if we buy a prepaid card of $10, we will have the full amount at our disposal, which we can use in all businesses that accept a paysafecard.

Also, unlike other gift cards, we can use the same paysafecard for multiple purchases in separate businesses.

There are more than 650,000 sales outlets all over the world, where we can buy a paysafecard. These include many supermarket chains, post offices, kiosks, etc.

We can also buy a paysafecard online 24/7. To use a paysafecard, all we have to do is to create a free account.

Once we are ready, we can also add prepaid codes that we might have bought from physical stores.

As a result, we can use our paysafecard account to checkout when we want to buy anything online.

Furthermore, we can top up our account with more money. If the amount runs out, our account won’t be charged anymore. It just won’t work for purchases until we top it up.

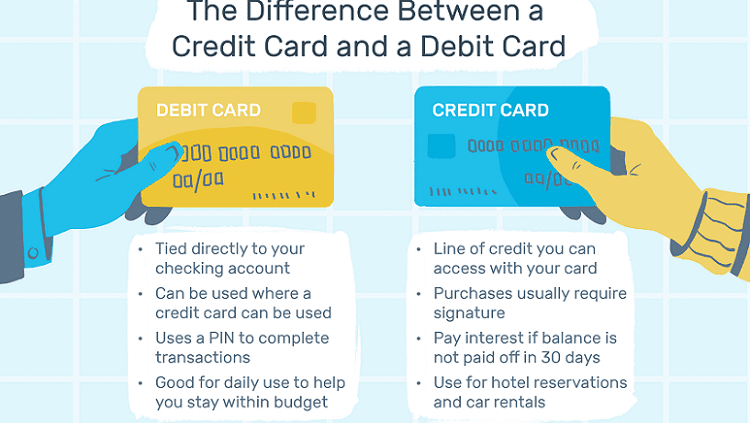

Credit cards

Credit cards can be a double-edged sword.

If we use them properly, they are handy and offer significant benefits compared to other payment methods. If we misuse them, they can ruin our lives.

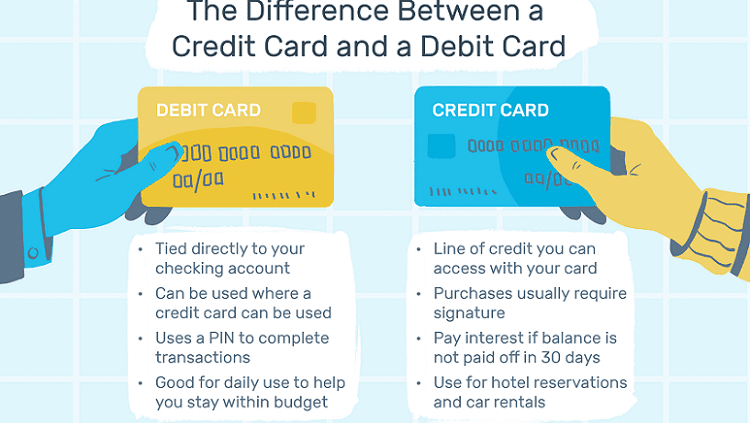

As we all know, a credit card is essentially “borrowed” money. If we have a monthly limit of say $1000, the bank lends us money for every payment by card, up to that limit.

Of course, every month we have to repay the credit. If we pay the full amount, we will not be charged any interest rate for all the purchases we made during the month.

But if we pay only part of the amount, or we can not pay, we will be charged a much higher interest rate than other forms of lending.

Pros

The great advantage of credit cards is the incentives they give us to use them.

Some cards give us a cashback on every purchase, for example, 10% of the purchase. And in certain partner companies, the rate of return may be higher.

Other credit cards may offer points for every purchase made. We can redeem these points for various products or services from a given list. For example, some credit cards give airline miles.

These types of benefits are rarely found on other types of cards. Some people have many different types of credit, which they use in turn to collect different bonuses.

Also, most companies allow shopping in installments only with a credit card.

Finally, any irregular charges on a credit card are typically easier to reverse if we detect them promptly than other types of cards.

Cons

The downside of credit is that if we have multiple cards and use them recklessly, much more than our income justifies, we will soon be mired in debt at an extremely high-interest rate.

Most of us know people who are in this situation. They have multiple cards in debt each month and issue new cards to debit old ones. The result is that it is challenging for them to get out of the debt cycle.

Finally, whether we will get a credit card and how big our credit limit will be, depends on the income we declare in our tax return.

The criteria are much stricter today than they were decades ago. Low-income people may not be able to get a credit card at all.

Debit cards

For several years now, if we have a bank account, we also get a card that allows us to withdraw cash from an ATM or be used in any purchases. This is called a debit card.

Pros

Virtually anyone can have a debit card, even if they have only one bank account. The issue of a debit card doesn’t depend on our income.

Instead of carrying cash, we can use this card, and the amount is automatically debited to our bank account.

Also, there is no monthly fee that we pay for the card nor any interest rate.

Cons

However, as we mentioned, the debit card is directly connected to our bank account. In case of loss or theft, or if we fall victim to online fraud, the thieves will have direct access to our money.

Most debit cards have a limit, daily or even monthly, to not empty our account before we cancel the card. But this limit is probably higher than the limit of a credit card.

We should also ask our bank about their debit card policy. What if we find irregular charges? Under what conditions can we get our money back?

Finally, note that some payments may require a credit card, not a debit card.

For example, renting a car almost always requires a credit card, not a debit card. The same goes for various other types of transactions.

What to look out for in each type of card

Here are five key pointers we should all be aware, before using any card online.

Where do I enter the card’s number, and why

The first is that we need to understand exactly what will happen if we enter our card number into any website.

If it is a purchase from an e-shop, usually just before the payment, we will see an overview of the products we have selected, along with shipping and possibly other charges.

In online services, however, things are not always so clear. For example, several services ask for a card if we want to do a free trial.

Our card is not charged at that time. However, if we do not cancel the service in time, it will start charging automatically as soon as the free trial expires.

We have seen something similar happening in software products. For example, we might buy an application today at a significant discount. We are automatically charged the full price for the latest version of the same application one year later.

The same goes for monthly or annual subscriptions. They promise a reduced price only for a while, and then the cost rises sharply.

Finally, some pages ask for a card to certify that we are adults. Often this will register us for so-called “bonus” subscriptions to sites of this kind.

Thus, we should always read all the terms and conditions before entering our card’s number. Especially in free trials or for age confirmation, we have to be extremely careful.

Check what the browsers show

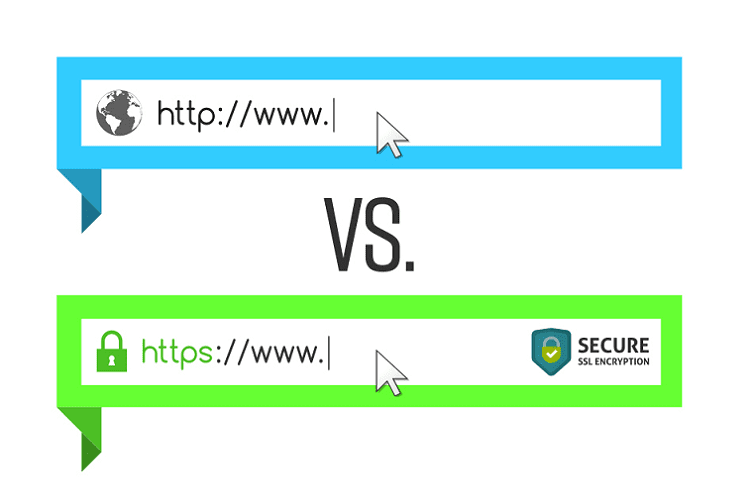

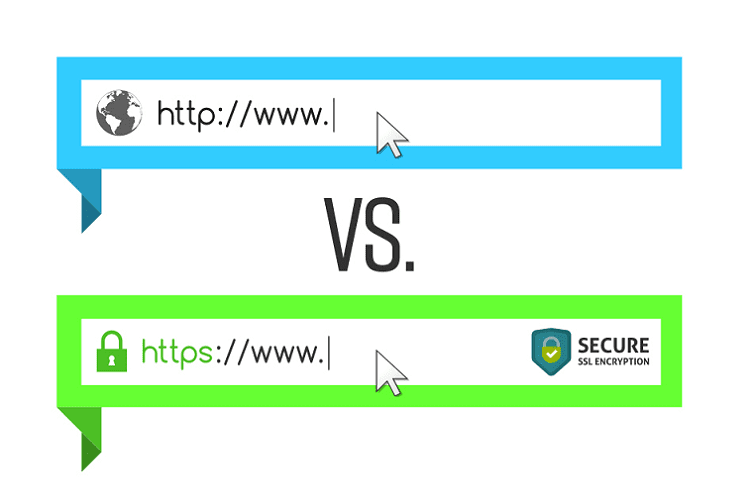

The second thing to look out for before using a card online is exactly what the browser shows in the address bar.

Initially, the address must start with HTTPS, which means that our communication with the page is encrypted. We should NEVER use a card or any of our personal information on a page with just HTTP.

Chrome has been automatically hiding both HTTPS and “www” in the address bar for several versions. However, if a page does have HTTPS, Chrome displays a locked padlock just before the address. You will find a similar padlock in Firefox and most other browsers.

To highlight how important this is, Chrome marks pages as unsafe if they have just “HTTP.”

This doesn’t mean they are dangerous. However, it is certainly not safe to enter our personal details or our card number.

Beware of Phishing

We must definitely pay attention to the website address itself before entering our card number.

We have to make sure that we are entering the number on the site we want and not to a third site that copied a known website’s design.

For example, a viral scam has to do with Netflix. We might receive an email that there’s a problem with our Netflix subscription, and we have to re-enter our payment details.

If we follow the mail’s link, it will take us to a website that looks like Netflix. However, this site is hosted on a different server and has a different domain.

Nothing good will happen if we enter our card details on such a site.

This type of scam is known as “Phishing.” Besides Netflix, these types of emails might pretend to come from our banks.

In case we receive such an email, we shouldn’t follow any link. The best we can do is open a new tab and log in manually to the website’s user panel, whether it’s Netflix.com or our bank’s website.

If there’s any problem with our account, we will see it in our user panel. If we can’t see any issues, we should mark the email as spam and delete it.

In any case, if we still feel there might be a problem with our account, we can call our bank and ask for details.

Up-to-date devices

We should always keep our devices clean from malware and up-to-date. Also, we must update our antivirus software daily. Moreover, we should pay attention to the sites we visit and the files we download.

There are specific categories of malware dedicated to recording what we type, what we see on our screen, what we copy/paste, or a combination of these.

Such applications look specifically for credit card numbers or credentials for our e-banking.

Users who download cracked software and games are at a higher risk of running into such malware. The same goes for people who open attachments from emails without being sure of their origin.

In general, an updated antivirus is enough for protection. There are also more advanced methods, such as:

- A special sandboxed browser for online payments

- A live linux distribution on a USB stick that we use exclusively for payments

Did we notice any weird charges?

Last but not least, we should always monitor our card’s charges. It is essential to recognize every purchase that we made.

We should make it a habit to look at the charges on our card regularly, ideally once a day. We can do this either through e-banking or through a card-specific application, if available.

If there’s any charge that we don’t recognize, we should contact our bank, even if it’s a small amount.

The sooner we detect such payment and inform the bank, the more likely we will reverse it.

Do you shop online with a card?

If you want to share your opinion about online shopping or your personal experience with a credit, debit, or prepaid card, you can write us in the comments.

Support PCsteps

Do you want to support PCsteps, so we can post high quality articles throughout the week?

You can like our Facebook page, share this post with your friends, and select our affiliate links for your purchases on Amazon.com or Newegg.

If you prefer your purchases from China, we are affiliated with the largest international e-shops: